Collection Processes Optimization

The client had a vital need to re-balance its receivable portfolio. On one hand, its debt recovery rate was 3.4 percent, compared to 19 percent achieved by its competitors. On the other hand, the commissions charged by the client’s other collection agencies were as high as 50 percent of the collected amount, which resulted in high operational costs and a lower overall collection rate. Profit margins using them were dented. The client intended to optimize its final debt collection processes to improve recovery of receivables. The client also wanted to formulate focused debt management strategies for different customer segments to manage customer writeoffs more effectively and decrease operational costs.

Client:

One of the leading produce distributors on the East Coast

01. Сhallenge

The client wanted to optimize collection processes to improve recovery and create strategies to manage customer write-offs more effectively

02. Solution

RHK transformed the client’s collections process by leveraging analytics, consumer behavior and enhancing the customer interaction strategy.

RHK focused on transforming the client’s collections process by embedding predictive analytics and making changes to the customer interaction strategy. Key aspects of the RHK Solution:

- A Propensity-to-Pay Predictive Data Model exclusively for business customers. The model predicted the likelihood of businesses being able to collect! The model assigned a propensity-to-pay score to every business.

- Business classification broken into high, medium and low propensity-to-pay segments based on their scores.

- Focused delinquency management strategies for every segment.

- Business segment prioritization. Certain segments were prioritized on the basis of the propensity-to-pay scores and the amount of outstanding debt.

- Rigorous cost-benefit analysis to streamline operational, financial and human resource activities. This exercise was instrumental in optimizing the debt management process.

- Engaging with businesses . The customer service executives used customized call scripts and pre-determined verbiage to conduct settlement negotiations and provide debt management advice to customers.

- Performance monitoring of pilot strategies against critical tactical and quality indicators and also against the parameters set by the standard process.

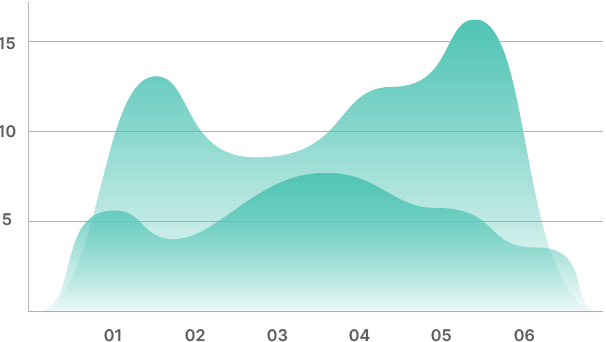

65

Analytics

90

Consumer Behavior

80

Customer Interaction Strategy

03. Benefits

The client achieved a 37 per cent improvement in debt collection in three months.

By deploying predictive analytics, RHK Recovery Group was able to fulfill the client’s business objectives and helped achieve the following outcomes:

- Debt collection increased by 42 percent within 3 months

- The modified process recorded an 8 percent rise in conversion rates compared to the standard process

- Operational expenses decreased by 20 percent